Picture this: You’ve spent $100 on Greyhound tickets from Cleveland to New York City, where you’re going next month to see an Off-Broadway show starring your college roommate.

But a few days before you’re set to travel, you get an email from your boss: He needs you at a conference in Las Vegas this weekend — no ifs, ands or buts. In short, your New York getaway is toast.

Fortunately, you bought trip protection when you booked your tickets. Turns out your cancellation is fully covered, despite the last-minute change. (Sure, your old roommate will be bummed, but you’re only mildly disappointed to be missing a one-man show called “TikTok: Live!”)

Now pause. This hypothetical could be your story!

Thanks to a recent team up with Allianz Global Assistance, trip protection is now available on Wanderu — because bus and train travelers deserve peace of mind, too. You never know what sort of unexpected circumstances may upend your plans, so why not bag a safety net for only a fraction of the cost of your ticket?

Below, find detailed info about what trip protection covers, when you should consider purchasing a plan, and how to file a claim.

What does trip protection cover?

Trip protection covers a number of different scenarios, providing refunds and reimbursements for situations in which you’d otherwise be left high and dry.

One major advantage that most travelers miss: Many benefits of trip protection extend for the entire time you’re away from home. For example, that means if your suitcase were to be lost at the hotel, stolen at a coffee shop, run over by a taxi, whatever — you’d still be covered. Trip protection is comprehensive, not just limited to the time you’re physically on the bus or train.

For Wanderu users, Allianz offers two different plans for bus and train tickets: Future-Day Trip Departure and Same-Day Trip Departure.

Next, here’s a snapshot of the benefits included in each plan, along with a section-by-section breakdown explaining exactly what they entail:

| Coverage | Maximum Benefit |

|---|---|

| Trip Cancellation | Up to 100% of trip cost |

| Trip Interruption | Up to 150% of trip cost |

| Travel Delay |

$400

Daily max: $200 with receipts $100 without receipts Min required delay: 2 hrs |

| Baggage Loss Coverage |

$750

($500 high value item max.) |

| 24-Hour Assistance | Included |

|

Pre-Existing Medical Condition

Exclusion Waiver |

Available |

- Trip Cancellation is for if something comes up more than 24 hours before your departure that obligates you to call off the trip entirely. Covered reasons for cancelling include serious illness, injury, death of a family member, being laid off from your job or being required to work.

- Trip Interruption is for within 24 hours of your departure and for during the actual trip itself. It covers all the same things as Trip Cancellation that might thwart your travel plans last minute — including if you’re unable to complete 50 percent or more of your journey (e.g., if your trip has multiple legs but the second bus never shows up). If you’re stranded somewhere and the bus or train company can’t reroute you, you can even find alternative means to get to your destination for which trip protection will later reimburse you.

- Trip Delay is for unexpected costs that may arise from a delay, such as meals or accommodations. Covered delays include a late bus or train, an unannounced strike or a natural disaster. Note that the delay must be for a minimum of two hours before you’re eligible to file a claim. If you can provide receipts for your purchases, you can be reimbursed up to $200 per day. Without receipts, you can be reimbursed up to $100 per day.

- Baggage Loss Coverage is for if your luggage gets lost or stolen on your trip. You can be reimbursed for your lost luggage items (including the bag itself) up to $750. The one caveat is that you can’t claim more than $500 for any one item (so you’re better off keeping that $600 Rolex on your person).

- 24-Hour Assistance is where your trip protection evolves beyond just travel insurance, and becomes a service that can help you out of all kinds of mid-journey jams. In this example from Allianz, a policyholder who is hit with an allergy attack calls the 24-hour assistance line for info on where the nearest drug store is located, what over-the-counter treatments are available and where they can find the nearest clinic. Allianz’s 24-hour assistance hotline can be reached at 1-800-654-1908.

- Pre-Existing Medical Condition Exclusion Waiver is for if you have a pre-existing medical issue or injury prior to buying your tickets, such as a sprained elbow, that then worsens after booking. This waiver means that if your trip must be cancelled, interrupted or delayed because of complications related to your pre-existing condition (like if your sprained elbow suddenly needs surgery), you will still be eligible for reimbursements from trip protection.

Now, here’s a snapshot of the benefits included in the Same-Day Trip Departure plan:

| Coverage | Maximum Benefit |

|---|---|

| Trip Cancellation | N/A |

| Trip Interruption |

Up to 150% of trip cost

$400 maximum |

| Travel Delay |

$400

Daily max: $200 with receipts $100 without receipts Min. required delay: 2 hrs |

| Baggage Loss Coverage |

$750

($500 high value item max.) |

| 24-Hour Assistance | Included |

|

Pre-Existing Medical Condition

Exclusion Waiver |

Available |

Note that the only difference between the Future-Day Trip Departure plan and the Same-Day Trip Departure plan is that Future-Day includes coverage for Trip Cancellation. That’s because anything that hinders your travel plans within 24 hours of your departure falls under the Trip Interruption category.

How can I purchase trip protection?

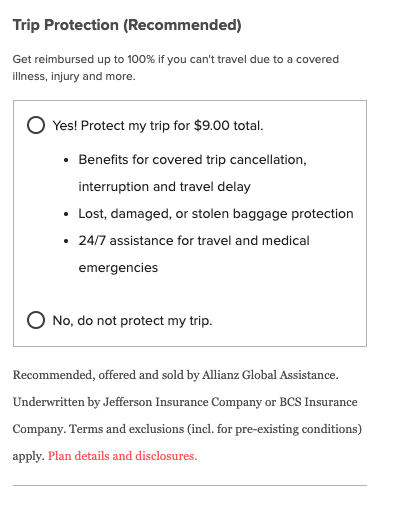

Trip protection is available for purchase on the Wanderu checkout page. After you enter your billing information, continue to scroll down the page and you’ll find a box like the following:

There you’ll see a quote for trip protection, along with a bulleted list of benefits. You’ll also be given the opportunity to either purchase the policy or decline it.

Trip protection is provided by Allianz Global Assistance (a world leader in the travel insurance and assistance industry), and following your purchase you’ll be sent a confirmation email from Allianz directly. In that email, you’ll find a “Manage My Policy” link, where you can review, modify or cancel your trip protection, like in the sample confirmation email below.

How can I update my trip protection?

If you end up changing your travel dates or making some other adjustment to your original plans, you’ll want to make those same changes to your trip protection policy as well to ensure you stay covered.

To do so, just follow the “Manage My Policy” link in your confirmation email, or call Allianz customer service directly at 1-800-284-8300. Provide your policy number (the one that comes in your confirmation email) and they’ll be able to pull up your policy and make the necessary modifications.

Say that you bought an Amtrak trip on Wanderu from Los Angeles to San Diego, where you’re departing on a cruise. You can also add the cruise to your Allianz policy, even though it wasn’t purchased on Wanderu. To do so, follow those same steps — either making the changes online or calling a customer service representative. Just note that policy additions (and some modifications) will result in an increased balance that you’ll then have to pay off.

How can I file a claim?

If something happens and you need to file a claim, Allianz has a quick and intuitive process to see what paperwork you’ll need to provide. Just visit their page on Required Documentation and select the type of claim that best describes your incident. From there, you’ll be able to see the items you’ll need to attach — for instance, if you had to cancel your trip for a covered reason, you’d need to provide: proof of payment, proof of incident, penalty/refund information (if applicable) and a letter from your employer (if applicable).

A pro tip: For purposes of trip protection, save all of your travel receipts and confirmations. In the unfortunate event that you need to seek a refund or compensation of some type, the claim-filing process will go way more smoothly if you already have the records on hand.

Once you have the right documents in order, you can either log in to your Allianz account to actually file the claim, or can do so by looking up your policy on the main Allianz website.

Does Wanderu provide trip protection outside of the United States?

Unfortunately, at this early stage, our partnership with Allianz only extends to U.S. residents traveling domestically. Trip protection is also limited to bus and train trips (as opposed to flights or ferries), and is not yet available for 100 percent of the carriers on Wanderu. Over time we plan to improve and expand our offerings beyond the U.S. to all of the trips in our inventory.

What if I have more questions about my trip protection plan?

If you have additional inquiries about trip protection, you can view the policy documents linked in your confirmation email, contact Allianz directly at 1-800-284-8300, or email your question to [email protected].

And that about covers it — both the info in this blog post and your trip protection policy.

There are loads of situations in which trip protection is worthwhile, but a few of the top ones include:

- The tickets you’re buying are expensive, so if something unexpected comes up you want to be eligible for a full refund.

- You’re booking a trip far in advance, and realize there’s a possibility your circumstances could change between now and then.

- Your work schedule is unpredictable and inflexible, so you’re not always sure when you’ll be assigned a shift.

- You’re traveling with some expensive items and are afraid of them being lost or stolen.

The list goes on. So when it comes to booking your next bus or train trip, know that Wanderu can put your mind at ease. Purchase your trip insurance at checkout on Wanderu.com or — coming soon — on the free Wanderu app.

Want to learn how to score the absolute best deals on Wanderu? Try out these travel hacks when booking your next trip.